We Just Hit $3,000,000 Net Worth. This Is Exactly How We Did It.

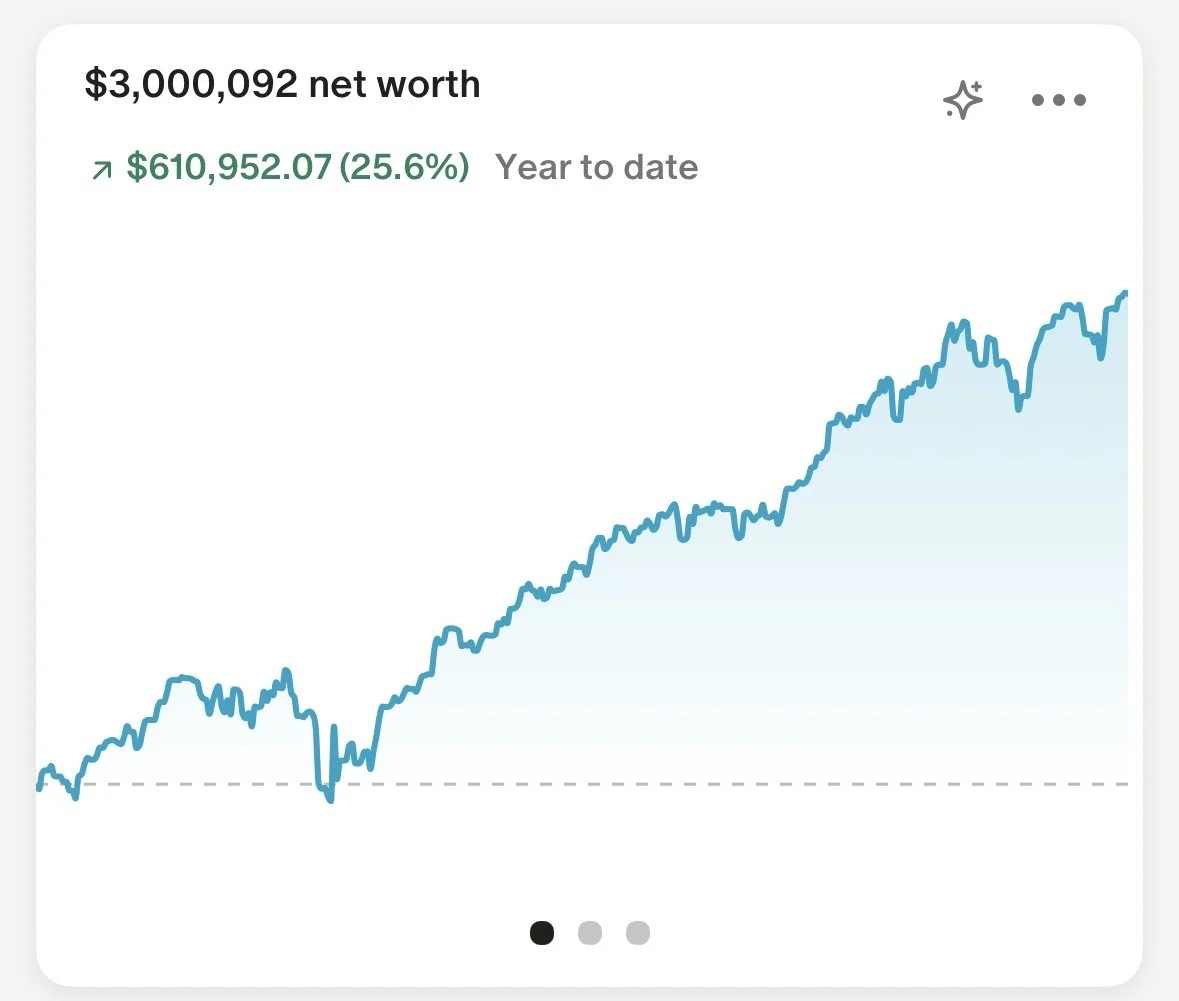

This is a graph of our Net Worth Growth trajectory since January 1, 2025- from Monarch Money. +$610,952.07 in 2025.

From $600 to $3,000,000 Through Consistency, Investing, and Time

Today we crossed a milestone that once felt unreachable- we hit $3,000,000 Net Worth.

$3,000,092.16 to be exact.

It feels crazy to type these words- Three Million. But I shouldn’t be surprised- we created a system that works no matter who you are, and we follow it just like we teach others to do.

I am sharing this not because the number itself matters, but because the process does. I know how many people are doing everything they were told to do and still feel stuck. I am sharing because having money quietly dictates freedom, options, stress levels, and how you can spend your valuable time- whether we talk about it or not.

I coach families every single day about how to build wealth and live life on their own terms. I do so through a company I created called Align Money Mastery- more to come on that.

I am sharing this because we have helped 130 families since Align Money Mastery was founded- and if even ONE MORE person reads this and decides that it’s time to change their financial life, the time I spent writing this was well worth it.

We share our finances in explicit detail for a simple reason: money quietly influences nearly every part of modern life. Those without it face more stress, fewer options, and harder trade-offs. Those who learn to manage it well gain freedom, flexibility, and the ability to live on their own terms. Transparency matters because understanding money changes outcomes.

We reveal our exact numbers for the following reasons:

We believe that society has made money "Taboo", "Uncouth" or not proper to talk about freely- and that does our society a disservice when people spend the majority of their lives trying to make money.

We believe that it is not difficult to build wealth and make millions of dollars in a lifetime- and that it is intentionally being made more difficult to understand by "financial advisors", "wealth managers", and the Media. Also- the amount of financial related scams in our culture are alarming.

We believe that if people are to trust us with teaching them what we know- we need to be radically transparent in order to build validity. We need to show that we are not only practicing what we preach- but also that it creates results.

The Purpose of this article is to reveal exactly how I (now proudly WE with my wife Jacquelyn Breedlove) started with NOTHING and created $3,000,000 in wealth.

Where It Began

I started tracking my net worth at 17 years old. It was 2007. I had $600 to my name.

No trust fund. No inheritance. No financial blueprint handed down. Just curiosity, discipline, and a deep desire to never feel financially trapped.

If you don’t know my story, I have been on a ton of podcasts on which I go through great detail about how my life began- I’ll give you the short version here (if you want to learn more, HERE is a good video to watch).

I grew up in a household warped by drug and alcohol addiction. Money was not a concern for me as a kid because I had more pressing needs- safety and security. I moved out at 17 years old starting with $600 to my name.

ME (far left) with my family- I love this picture.

I started with nothing. I now have a $3,000,000 Net Worth because of 18 years of consistency. I continued by investing small amounts of money. I am not special. You are also not special.

I say that not to make you feel bad about yourself, but to make you feel normal. You are not a victim of your circumstances- you are a product of your choices. You, just like me, can build millions of dollars of Net Worth.

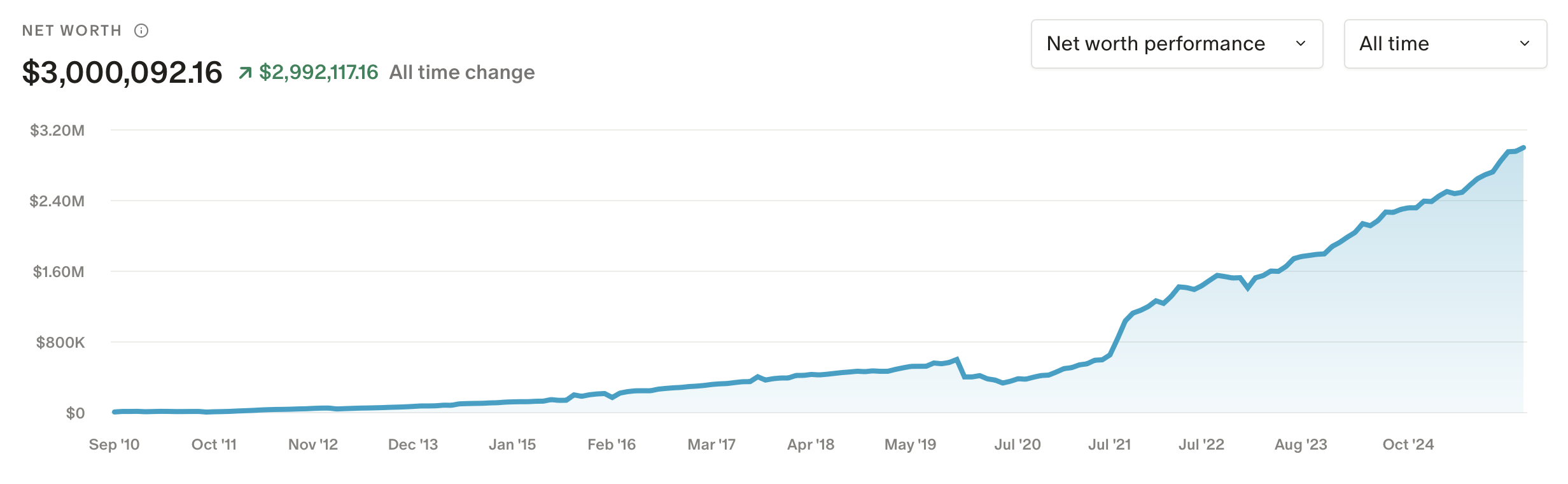

The Long View

We hit $1,000,000 Net Worth on July 12, 2021.

That first million took 14 years. Fourteen years of learning, undoing habits formed in childhood, working demanding jobs, and choosing progress over comfort more times than I can count.

At the time, it felt like summiting Mount Everest. I genuinely believed that if I slipped, even a little, everything could unravel.

Then something interesting happened.

We hit $2,000,000 on February 26, 2024.

And today, December 27, 2025, we hit $3,000,000.

Each million has come faster than the last- easier than the last.

It was easier not because we suddenly became smarter, and not because we took bigger risks. It’s because time and compounding finally took control.

Who We Actually Are

This part matters.

My wife Jacquelyn and I have normal careers. I am a BSN prepared Registered Nurse by training, with years spent in ICUs, transplant units, rapid response, and leadership roles. I later transitioned into medical and pharmaceutical sales, where I built a career by being a clinical expert first and a salesperson second.

That mindset carries over directly into how we manage money.

No gimmicks. No shortcuts. No blind trust.

We built Align Money Mastery in January 2023 because we realized how broken financial education really is. I had spent years watching smart, hardworking people make avoidable mistakes simply because no one ever taught them how money actually works.

We teach exactly what we do.

We didn’t just save- we lived as well. We are living proof that you can hit your financial goals and still live a fulfilling life. This is us in Corfu, Greece (July, 2025).

What Changed After Our First Million

Hitting $1,000,000 changed my relationship with money.

I stopped obsessing over small mistakes. I stopped losing sleep over purchases that aligned with our values (this felt great) We started enjoying life more, not less.

What we doubled down on was planning. Intentionality. Cutting expenses that added no value while fully enjoying the ones that did.

What never changed was our monthly money meeting. We have followed the same budgeting process since 2010. Same structure. Same discipline. Same rules.

Consistency beats intensity every time.

The Belief I Let Go Of

The day we figured out we hit $1,000,000- July 12, 2021.

For years, I believed small setbacks were catastrophic. That one wrong move could undo everything.

That belief came from scarcity- watching money be a source of stress growing up. It came from feeling like progress could be taken away at any moment.

I do not believe that anymore.

Wealth is surprisingly resilient when it is built correctly. Trust the process. Stay invested. Let time do its job.

What $3,000,000 Looks Like in Real Life

Here is what our net worth looks like today:

Total net worth: $3,000,092

Real estate equity: $1,021,851.17

Taxable brokerage accounts: $992,775.88

Retirement accounts: $934,203.42

Cash: $54,000

HSA: $18,676.52

Business equity is not included: in Align Money Mastery or in unvested RSUs in the company stock we work for.

Investing = Freedom

Our taxable brokerage account has produced $318,083.32 in investment gains since January 1, 2025 alone.

That did not come from trading. It did not come from chasing headlines. It did not come from changing strategies every year.

In fact, our investing strategy has not changed since we hit $1,000,000. That is one of the most important lessons here.

Today, that account produces roughly 14 percent in annual dividends, paid monthly. One hundred percent of those dividends are reinvested. Every single dollar goes right back into assets that produce more income.

This is what most people miss. Compounding does not require brilliance. It requires staying consistent long enough for math to take over.

Consistency Is Key But So Is Intensity

We will go over the details of our income below in more detail, but in this section I want to share the intensity with which we saved this year

Your amount of income is not the most important part for you though. The two main contributors to how fast wealth builds relative to your income is the following:

1. The percentage of your income that you invest

2. What you invest in

If you save more, it grows more- that seems obvious.

The detail that most people miss is WHAT you’re investing in. What investments are inside your 401(k)? What fees are they charging you? Did you even know that you could change what your 401(k) is invested in? (if not, you’re not alone) Are you investing outside of retirement so you can retire early? These are all questions you should know the answer to.

Yes- I want you to save as much as possible, but I want you to do it consistently as well. People underestimate the power of putting even small amounts of money away consistently. When it is invested properly, it’s MAGIC.

For 2025- here are our details of income and savings rates:

Income Sources:

Rental Income: $41,137

W2 Pre-Tax Income: $376,774.17

Business Income: $94,040.62

Investment Income: $78,897.46

Credit Card Cashback/Upside: $3,441.86

Income Grand Total: $594,291.11

Savings Sources:

401(k) Savings: $56,629.47

HSA Savings: $4,300

Early Retirement Savings: $263,134 (Goal was $200,000)

Savings Grand Total: $324,063.47

Percentage of overall income saved/invested: 54.5%

You can do this calculation. You can be this consistent. You can be this intense.

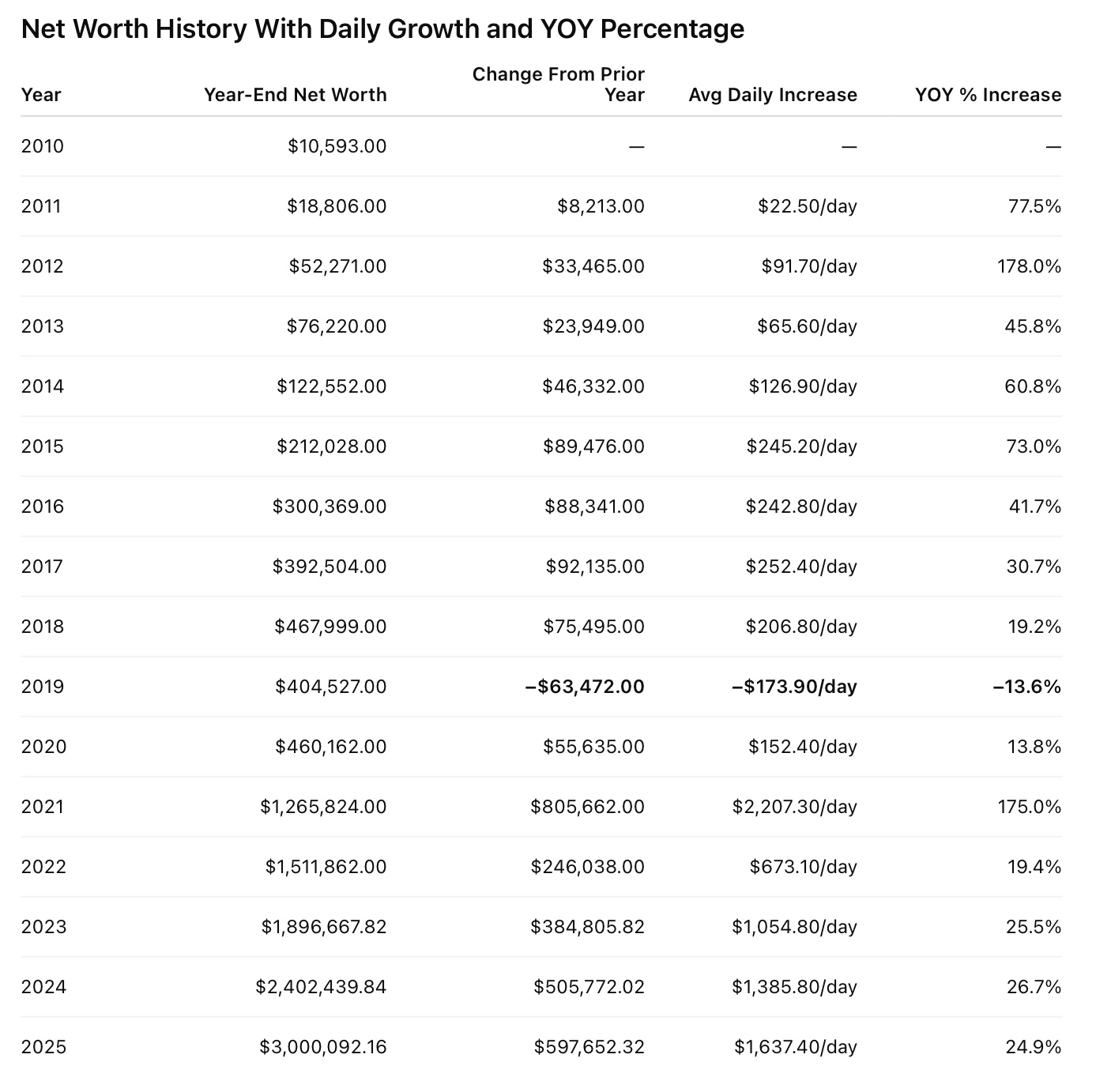

My (now our) entire Net Worth History since 2010. I know where every dime has gone for the last 16 years.

How We Measure Growth Differently Than Others

Our current combined pre-tax household income is around $600,000 per year- and growing. That is the gasoline for our wealth building machine.

But income is not what got us from $600 to $3,000,092- it is our process for managing money that is the secret weapon.

At Align, we have a unique way to measure progress. We calculate how much our clients’ Net Worth grows every day during the year. Here’s an example:

An Align Client’s Net worth in 2024 grew by $83,177. They joined Align Money Mastery as a client in February, 2024. There was 297 days left in 2024.

Their Net Worth grew $280.06 per day ($83,177 divided by 297)For 2025, that same client’s Net Worth grew by $165,103.92- Their Net Worth grew $457.35 per day.

This is a 63% year over year increase. We use this to set goals for the following year. We get shockingly close.

For transparency, here is our personal Net Worth increases year over year since 2010, plus more statistical analysis of growth:

This is why people who focus only on earning more often stay stuck. Income matters early. Assets matter forever- this is how Net Worth Growth snowballs over time.

Why This Matters for You

Most people never become Millionaires because they have no idea how to build wealth. It’s because they lack effort in learning how to do so. It’s also because the systems we have in place fail us- Certified Financial Planners are TERRIBLE at their jobs (more on that later).

Here’s also what I’ve learned about people + money after coaching people for over a decade:

People sit in cash waiting for certainty.

They follow advice that keeps them dependent on paychecks.

They assume investing is only for people who are already wealthy.

People don’t know that their 401(k) is invested poorly.

They don’t know that the investments they’re paying someone to manage are underperforming by a shocking amount.

They don’t know how much these are both costing them. Spoiler Alert: it’s a lot.

What We Have Built at Align Money Mastery

Through the Align Money Mastery investing arm called “Align Elite”- we have helped 31 families invest $15,746,977.99.

Those investments generate $1,732,577.40 in annual dividends.

That is income that shows up whether someone works overtime, takes a vacation, or steps away entirely.

The investing arm of our company is built for people who do not want to depend on a paycheck forever. People with no bad debt. People who want clarity, simplicity, and control. Even people starting with as little as $50 per week. Even small amounts of money can achieve amazing things for you.

We do more for our clients than help them invest. Here are some other statistics of what we’ve helped them achieve since we started Align Money Mastery:

Debt payoff: $1,029,347.34

Interest Saved: $129,068.85

We help you manage every aspect of your financial world- not just investing. It’s like personal training for your money. We will make you holistically financially fit- and here’s analogy of what we do:

We don't just help you exercise. We look at your diet and your sleep health- every aspect of your health.

Actually, managing money well is a lot like physical fitness. There are a lot of similarities.

An Invitation For You

$3,000,000 is not the goal. Freedom is. We have a measurable amount of time until we never have to work for money again. Can you confidently say that?

If you are waiting for the perfect time to invest, you are already paying for that decision- and it’s costing you a lot. Every month you wait costs you compound interest you will never get back.

We offer a free 30-Minute Financial Audit to everyone who wants one. No pressure. No sales pitch. Just clarity and a plan (you should book one right now).

If you want your money working harder than you do, start now.

Different actions create different outcomes- are your current actions getting you closer to never having to work again? If not, you belong here.

Book a Free 30 Minute Financial Audit Here —————->

Founder, Align Money Mastery