The Bitcoin Narrative is Falling Apart

Bitcoin has long been marketed as a safe haven. A place to store wealth outside of government control. Protection from a weakening dollar. An asset that should thrive during uncertainty.

That narrative is being tested right now, and the recent data does not support the story many investors believe.

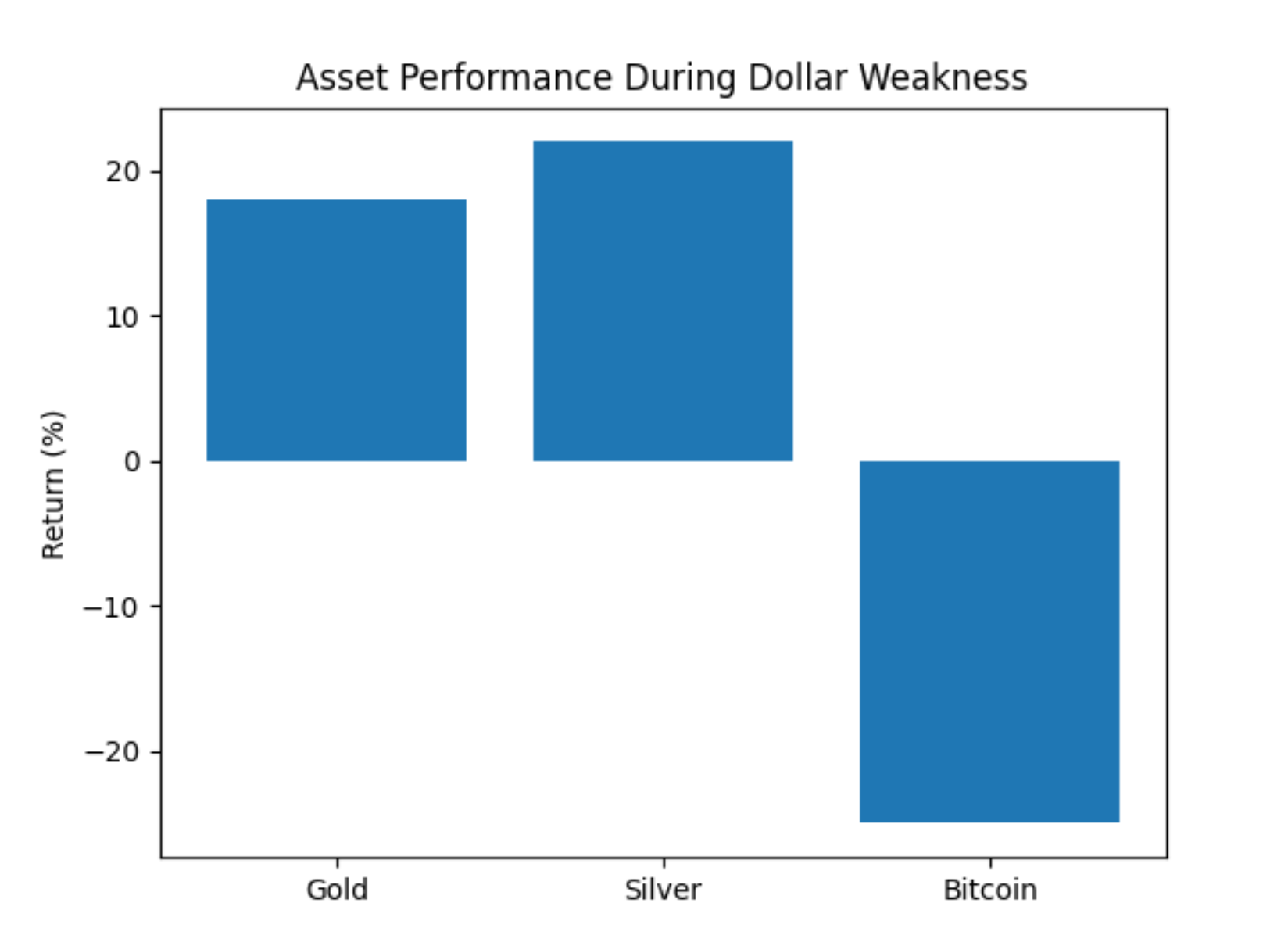

Over the last 12 months, the U.S. dollar has weakened. This was not a collapse, but it was a clear decline. At the same time, geopolitical risk increased across multiple regions of the world. Historically, this combination pushes capital into assets perceived as safe.

That is exactly what happened with gold and silver. Both surged to historic levels as investors sought stability.

Bitcoin, however, did not behave the same way.

During the same period when the dollar weakened and uncertainty increased, Bitcoin fell sharply. If Bitcoin truly functions as an alternative to the dollar and a safe store of value, this price action is difficult to reconcile. The asset did not respond the way its proponents claim it should.

Another important data point came after President Trump announced his new Federal Reserve Chair, Kevin Warsh. Following that announcement, gold, silver, and Bitcoin all sold off again. Markets appeared to be pricing in expectations of a stronger dollar and renewed confidence in U.S. backed assets.

Bitcoin is now down roughly 37 percent from its peak. There were two major selloffs tied to global market shifts. One of those shifts should have driven Bitcoin higher if it were functioning as a true safe haven. It did not.

The performance gap is hard to ignore. An investor who put $100 into Bitcoin one year ago now has roughly $75. That is a loss of about 25 percent, and Bitcoin remains more than 35 percent below its all-time high near $124,000.

Over the same period, $100 invested in the S&P 500 has grown to roughly $120. That represents a meaningful performance advantage versus Bitcoin during a period when Bitcoin should have theoretically shined.

Yes, Bitcoin has outperformed the S&P 500 over the last five years, but by less than most people realize. The margin is roughly 40 percent, and that outperformance came with significantly higher volatility and drawdowns.

My view has not changed. I do not believe Bitcoin has intrinsic value, and I do not believe the U.S. dollar is at serious risk of losing its status as the world’s reserve currency anytime in the next 50 to 100 years. That alone limits Bitcoin’s relevance as a replacement monetary system.

Blockchain technology, however, does have real value. Its usefulness just exists outside of the Bitcoin-as-digital-gold narrative.

This does not mean Bitcoin is finished, nor does it mean it has no place in markets. It does mean that investors should be honest about what it is and what it is not. Right now, Bitcoin is not behaving like a safe store of wealth.

I will continue to watch how this asset class performs relative to markets with decades of proven history. It is fascinating to study. But the narrative deserves scrutiny, not blind belief.